Personal Loans Canada - The Facts

Personal Loans Canada - The Facts

Blog Article

An Unbiased View of Personal Loans Canada

Table of ContentsPersonal Loans Canada - The FactsThe Greatest Guide To Personal Loans CanadaPersonal Loans Canada for DummiesFascination About Personal Loans CanadaThe Only Guide to Personal Loans Canada

For some loan providers, you can examine your eligibility for an individual loan by means of a pre-qualification process, which will show you what you might get approved for without dinging your credit rating. To guarantee you never miss out on a car loan payment, think about establishing up autopay if your lender supplies it. Sometimes, you might even get a rates of interest discount rate for doing so.This includes:: You'll need to confirm you have a work with a stable earnings so that you can pay back a finance., and various other information.

Some Known Details About Personal Loans Canada

, which is used to cover the expense of processing your finance. Some lending institutions will certainly let you pre-qualify for a loan prior to sending a real application.

This is not a difficult credit report draw, and your credit history and background aren't impacted. A pre-qualification can help you weed out loan providers that won't give you a funding, but not all lending institutions offer this alternative. You can contrast as many lending institutions as you 'd such as with pre-qualification, by doing this you just have to finish a real application with the lender that's most likely mosting likely to approve you for an individual loan.

The greater your credit history, the most likely you are to receive the least expensive rates of interest offered. The lower your rating, the more difficult it'll be for you to get approved for a car loan, and also if you do, you could finish up with a rates of interest on the higher end of what's offered.

Rumored Buzz on Personal Loans Canada

Numerous loan providers provide you the option to establish autopay and, sometimes, use an interest price price cut for doing so - Personal Loans Canada. Autopay lets you set it and forget it so you never ever need to bother with missing a car loan settlement. Settlement background is the biggest aspect when calculating your credit report, and falling back on finance repayments can negatively influence your rating.

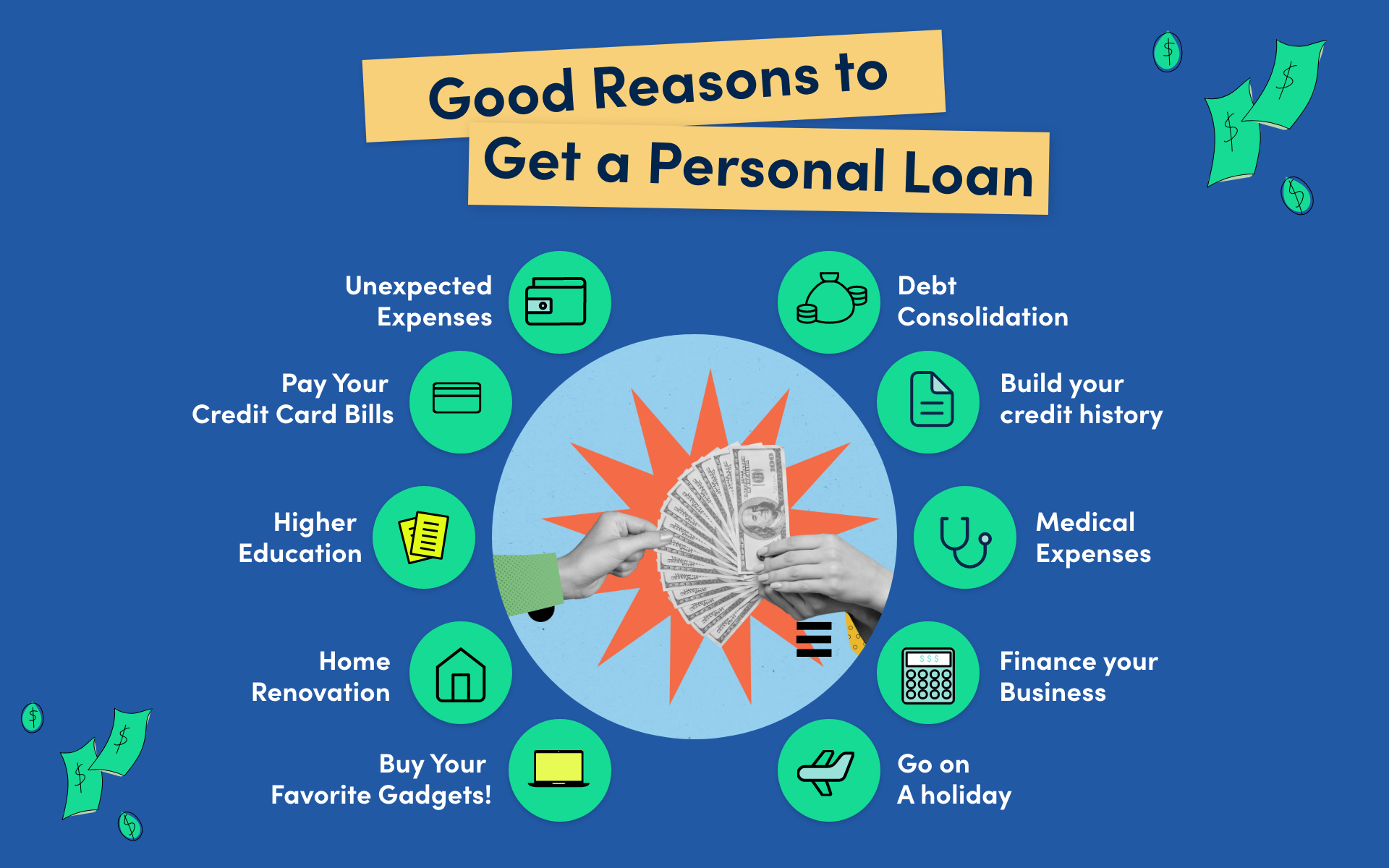

The consumer does not need to report the amount received on the financing when filing tax obligations. Nonetheless, if the financing is forgiven, it is thought about a canceled debt and can be tired. Investopedia commissioned a national study of 962 U.S. adults between Aug. 14, 2023, to Sept. 15, 2023, who had obtained a personal loan to learn exactly how they utilized their funding earnings and exactly how they could utilize future personal loans.

Both individual finances and credit cards are two options to borrow cash in advance, however they have various objectives. Consider what you need the cash for before you pick your payment alternative. There's no incorrect selection, however one could be far more pricey than the other, relying on your demands.

They aren't for every person. If you do not have excellent credit scores, you might require to obtain the help of a co-signer that accepts your finance terms alongside you, taking on the lawful responsibility to pay down the financial obligation if you're unable to. If you do not have a co-signer, you may receive an individual car loan with bad or reasonable credit report, but you may not have as numerous options contrasted to somebody with good or excellent credit.

How Personal Loans Canada can Save You Time, Stress, and Money.

A credit rating of 760 and up (outstanding) is Personal Loans Canada more probable to obtain you the lowest rate of interest price offered for your funding. Customers with credit score scores of 560 or below are most likely to have problem getting better finance terms. That's since with a reduced credit report, the rate of interest often tends to be also high to make an individual car loan a sensible borrowing alternative.

Some elements lug even more weight than others. 35% of a FICO rating (the kind used by 90% of the loan providers in the nation) is based on your repayment background. Lenders intend to make certain you can take care of financings sensibly and will take a look at your previous behaviour to get a concept of exactly how responsible browse around this web-site you'll remain in the future.

In order to maintain that part of your score high, make all your repayments on schedule. Can be found in 2nd is the amount of bank card debt superior, relative to your credit history limits. That accounts for 30% of your credit rating score and is understood in the market as the credit scores usage ratio.

The reduced that ratio the far better. The length of your credit background, the sort of debt you have and the number of brand-new credit score applications you have recently filled out are the other aspects that identify your credit rating score. Outside of your credit rating, lenders check out your income, job background, liquid assets and the quantity of overall financial debt you have.

Facts About Personal Loans Canada Revealed

The greater your income and properties and the reduced your various other financial debt, the far better you look in their eyes. Having a good credit report when requesting an individual loan is essential. It not only determines if additional resources you'll obtain accepted yet just how much interest you'll pay over the life of the funding.

Report this page